|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

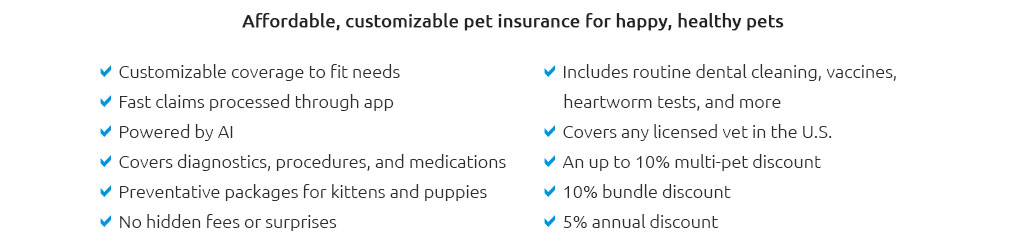

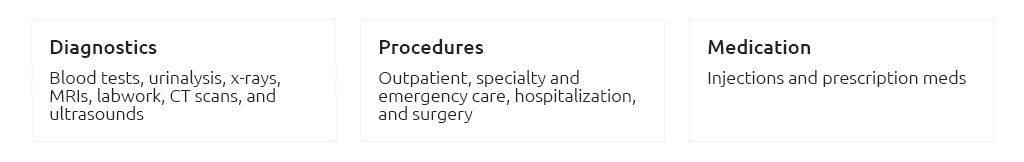

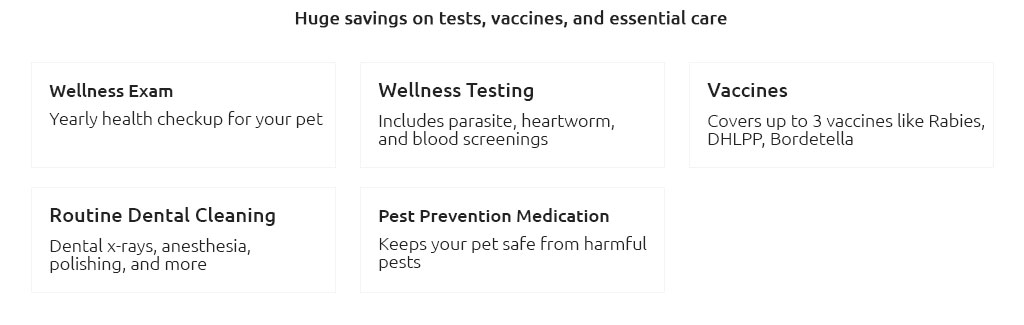

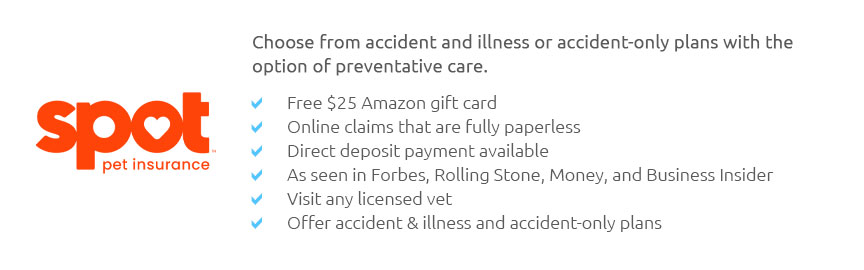

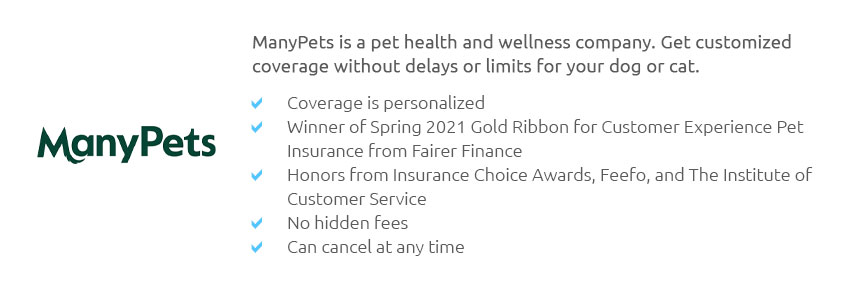

Exploring the Best Coverage for Pet Insurance: A Comprehensive GuideWhen considering the well-being of our beloved furry companions, it becomes imperative to explore the realm of pet insurance to ensure they receive the best possible care. As pet owners, the emotional bond we share with our pets is unparalleled, and with this bond comes the responsibility of safeguarding their health. In today's market, a myriad of options presents itself, each promising comprehensive coverage. However, the challenge lies in navigating these options to identify the best coverage pet insurance that aligns with both our pets' needs and our financial considerations. The significance of pet insurance cannot be overstated. Veterinary bills can quickly become exorbitant, especially in emergency situations or when dealing with chronic conditions. Thus, having a reliable insurance plan can alleviate the financial burden, allowing pet owners to focus on what truly matters: the health and happiness of their pets. But what constitutes the 'best' coverage? It often encompasses a blend of extensive medical coverage, reasonable premiums, and a seamless claims process. When delving into the specifics of a comprehensive pet insurance policy, there are several key factors to consider. First and foremost, the extent of medical coverage is paramount. The best policies typically cover a wide range of scenarios including accidents, illnesses, surgeries, and even hereditary conditions. Additionally, some insurance providers offer wellness plans that cover routine check-ups and vaccinations, which can be a significant advantage for maintaining your pet's overall health. Another critical aspect to consider is the cost of premiums. While it might be tempting to opt for the cheapest option available, it is essential to scrutinize what is included in the coverage. Often, lower premiums might mean higher out-of-pocket expenses when claims are made, or they may exclude certain conditions. Therefore, balancing affordability with comprehensive coverage is a delicate yet crucial task. The claims process also plays a vital role in determining the overall efficacy of a pet insurance plan. A user-friendly and efficient claims process can significantly enhance the experience of the pet owner. Insurance providers that offer straightforward online claims submission, coupled with quick reimbursement times, are often rated higher by consumers. This ease of use ensures that pet owners can focus on their pets rather than getting bogged down by paperwork and procedural delays. To provide a clearer perspective, let us explore some of the top contenders in the pet insurance market:

Each of these options brings something unique to the table, and the best choice will ultimately depend on your pet's specific needs and your financial situation. It is advisable to thoroughly research and compare policies, considering factors such as coverage limits, exclusions, and customer reviews. In conclusion, investing in the best coverage pet insurance is a proactive step towards ensuring the health and longevity of your furry family members. By meticulously analyzing the available options and understanding the nuances of each policy, pet owners can make an informed decision that provides peace of mind and unwavering support in times of need. After all, our pets are more than just animals; they are cherished members of our families, deserving of the best care we can provide. https://www.consumerreports.org/money/pet-insurance/is-pet-insurance-worth-it-a8622180631/

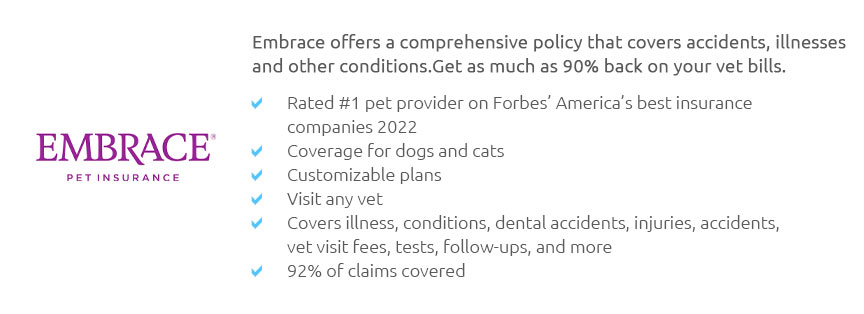

At Consumer Reports, we rated eight pet insurance providers: ASPCA, Banfield, Embrace, Fetch, Healthy Paws, Nationwide Pet Insurance, Pets Best, ... https://www.petsbest.com/coverage

Coverage Included With All BestBenefit Accident and Illness Plans - Accidents - Illnesses - Cancer treatments - Hereditary & congenital conditions - Emergency care, ... https://www.aspcapetinsurance.com/

We're committed to providing reliable, affordable, and trustworthy coverage so our pets can live happier, healthier, longer lives.

|